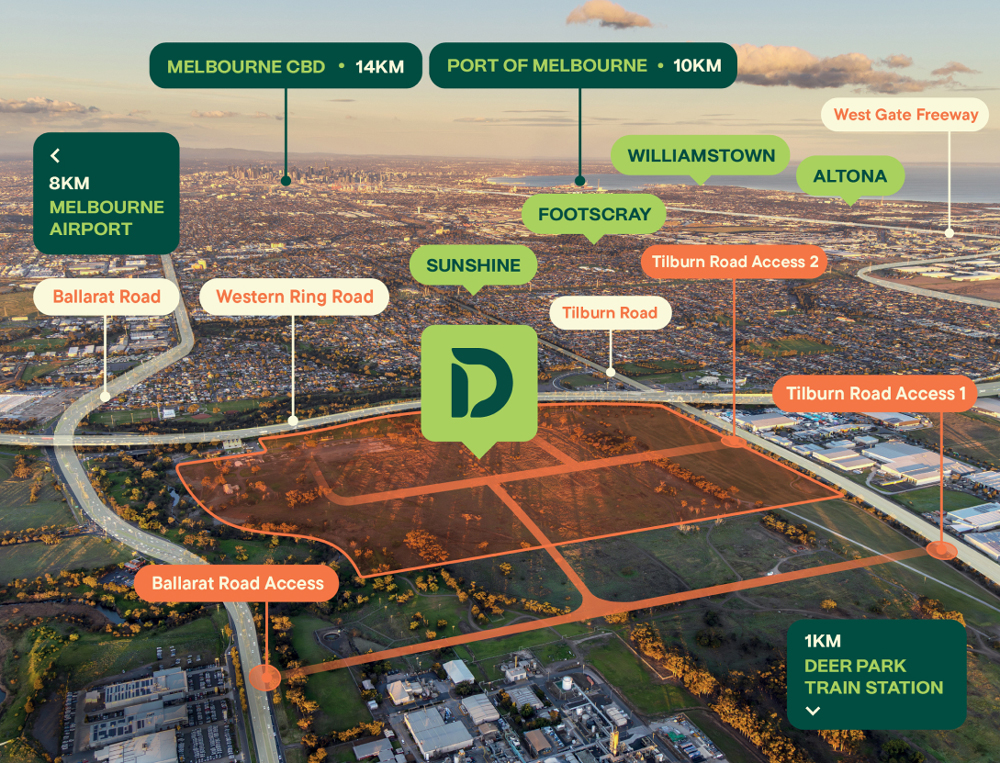

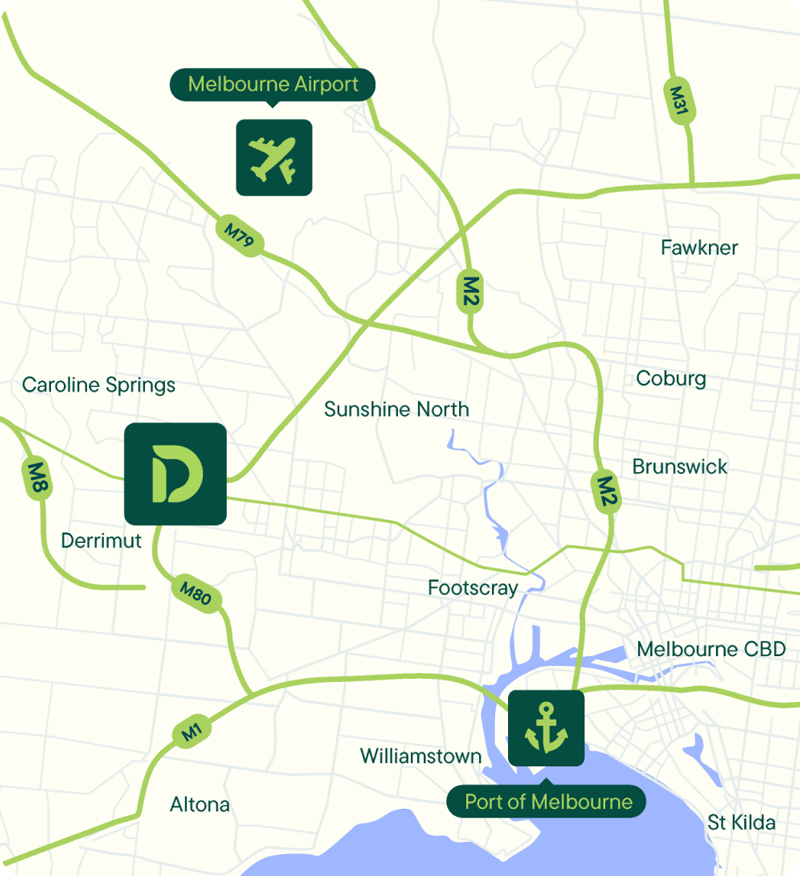

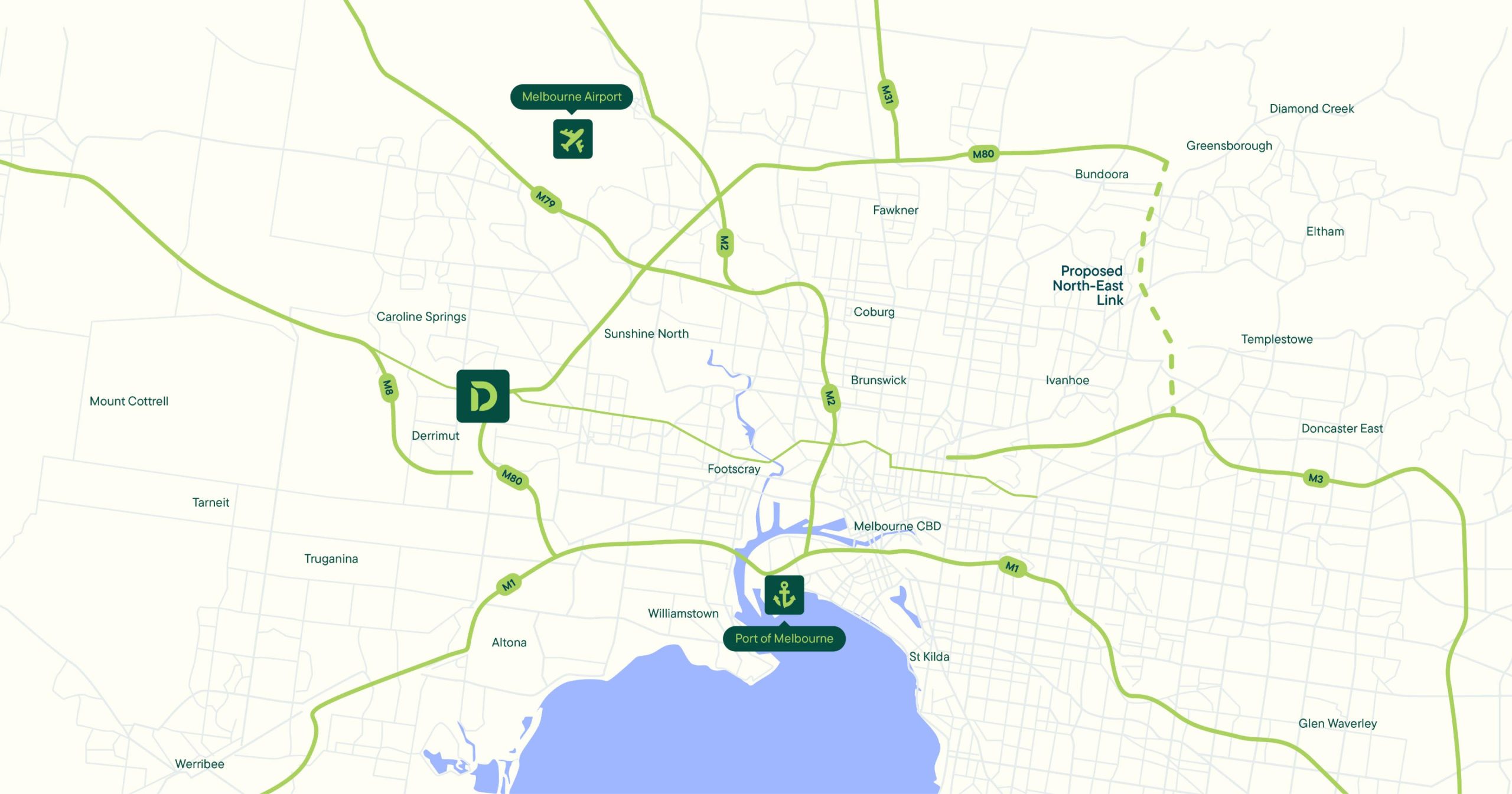

Strategically located on the Western Ring Road and Ballarat Road junction, Deer Park Estate provides direct access to major arterials empowering greater efficiency to key supply chain destinations.

A supremely connected address

Situated on the Western Ring Road and Ballarat Road junction, Deer Park Estate is Melbourne’s best-positioned logistics estate for access to the Port of Melbourne and Melbourne Airport.

Deer Park Estate outperforms all other estates in the immediate area for outstanding access to households, other industrial and retail precincts, intermodal transport nodes and interstate road networks.

A Prime Opportunity in Melbourne’s West

Deer Park Estate presents an unparalleled opportunity to join a prime logistics community in Melbourne’s west.

Proximity to freeway and arterial roads

24-hour operations

Flexibility in size and design

Height limit of 40m for highbay warehouses

B-double certified access

Access to local amenity at nearby Deer Park Activity Centre

Proposed complementary onsite Food & Beverage offering

Deer Park Train Station < 1km

Tree lined shared cycle paths and dedicated pedestrian access

Deer Park Estate has been designed with a best-in-class focus on sustainability and ESG that prioritises the comfort and wellbeing of the tenant and surrounding environment.

Rainwater harvesting enabling re-use for amenities and irrigation

Close proximity to Deer Park station enabling public transport commuting

Low to no Volatile Organic Compounds (VOC) content in proposed construction materials

Photovoltaic (PV) System with possible option for Battery Energy Storage System (BESS)

Drought tolerant landscape design and plant selections

Effective insulation and tinted windows to minimise energy consumption

Shared Pathway to accommodate and promote cycling as a commuting option

Fuel efficient / low emission vehicle parking spaces to discourage the use of Internal Combustion vehicles

Selection of building materials which have a lower environmental impact

Fully flexible by design

Deer Park Estate’s flexible precinct design can accommodate a wide range of size, scale and usage requirements, ensuring the ultimate fit-for-purpose format.

Precinct 1

Warehouse, Restricted Retail, Office, Food, Drinks, and Heritage Building

Size Range

Light Industrial approx. 500m² - 15,000m²

Max Height

10m

Precinct 2

Warehouse (including highbay) and Data Centre (STCA)

Lot Size Range

Lot/s approximate: 20,000m² - 178,000m²

Max Height

40m

Precinct 3

Warehouse

Lot Size Range

Lot/s approximate: 20,000m² - 166,000m²

Max Height

25m

Fully flexible by design

Deer Park Estate’s flexible precinct design can accommodate a wide range of size, scale and usage requirements, ensuring the ultimate fit-for-purpose format.

Precinct 1

Warehouse, Restricted Retail, Office, Food, Drinks, and Heritage Building

Size Range

Light Industrial approx. 500m² - 15,000m²

Max Height

10m

Precinct 2

Warehouse (including highbay) and Data Centre (STCA)

Lot Size Range

Lot/s approximate: 20,000m² - 178,000m²

Max Height

40m

Precinct 3

Warehouse

Lot Size Range

Lot/s approximate: 20,000m² - 166,000m²

Max Height

25m

About HB+B Property

HB+B Property is an integrated, family‑founded property developer with a strong focus on industrial, commercial, and infrastructure projects.

Backed by an experienced team with more than 100 years’ collective experience, HB+B Property is dedicated to realising top-tier outcomes and setting new standards for excellence in the development industry.

About UniSuper

Established in 1982, UniSuper is one of Australia’s top five superannuation funds, managing around $160 billion on behalf of 670,000 members. Supported by a team of over 800 employees, the fund takes a deeply considered approach to environmental, social and governance (ESG) investing, with more than $13.6 billion in ESG-themed assets. As a major long-term investor in Australian real estate, UniSuper holds over $14 billion in prime property assets nationwide.

About GPT

Listed on the ASX since 1971, GPT Group is a leading diversified property group with $36.6 billion in assets under management. Its vertically integrated platform is recognised for managing a diverse portfolio of strategically located, high-performing logistics facilities, in addition to retail and office assets, and delivered over 60% of the assets within its $4.7 billion¹ logistics platform. With more than 16 years’ experience in wholesale capital and strategic capital partnerships, GPT has managed UniSuper’s $3.2 billion¹ direct real estate mandate since September 2022.

1. As at 30 June 2025